Introduction

In the modern world of speed, smartphones have helped make our lives much easier. One such app that is useful is one called a Loan Lending Mobile App. These apps let people take out loans quickly, without the need for a bank. If you’re looking to begin an online loan company, creating a lending application is a good idea. This blog offers a complete guide on how to build an app for loan lending, from concept to launch, and how you can stay ahead in the ever-growing market.

What Is a Loan Mobile Application and How Does It Work?

A mobile loan application lets users request loans using their mobile phones. It connects lenders and borrowers through a secure online environment. The process generally begins by users creating an account and confirming their identity. Following that, they complete applications for loans that contain details about their income, loan amount, and the time for repayment.

The app makes use of automated systems to verify the creditworthiness of the users. If the credit is approved, the cash is transferred directly to the bank account of the user. Payments can also be made through the app with the mobile wallet, bank transfer, or debit cards.

The app keeps user information and tracks payments, as well as sends reminders. It also calculates interest based on terms that were reached upon. It’s a virtual lending office, which is accessible 24 hours a day. Users have access to everything via their mobile phone, without paperwork or long lines.

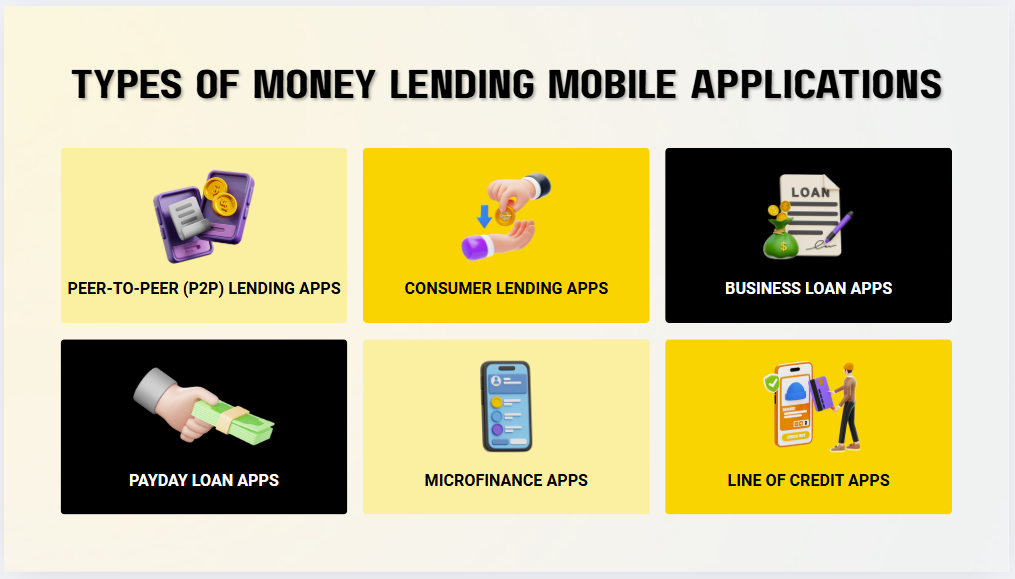

Types of Money Lending Mobile Applications

There are many kinds of apps for money lending, and each of them serves an individual group of customers. Here are the most commonly used kinds:

1. Peer-to-Peer (P2P) Lending Apps

The apps allow borrowers to connect with lenders who are individual lenders. The app functions as a platform for lenders to connect the customers and handle the repayments. The interest rates can vary based on the credit score of the borrower.

2. Consumer Lending Apps

The apps are utilised by those who require personal loans. It could be used for education, home improvement or shopping. The app has an unbeatable interest rate as well as repayment conditions.

3. Business Loan Apps

These applications help small and medium-sized companies receive loans quickly. They can provide the option of working capital as well as invoice finance, as well as equipment financing. Documents for business are required to verify the business.

4. Payday Loan Apps

These are loans that are short-term in nature and are designed to aid users in obtaining smaller amounts to get by until their next pay day. Rates of interest are generally very high, and repayments are usually due within a few weeks.

5. Microfinance Apps

They cater to those with a low income or who aren’t able to access banks. The apps offer loans of small amounts with low interest rates.

6. Line of Credit Apps

They give the user access to an amount of credit instead of one-time loans. You can take out a loan at any time and make repayments in a flexible manner.

Each one has different requirements, so choose the one that best fits your business strategy.

Latest Digital Lending Trends in Loan Lending Apps

Digital lending is expanding rapidly. Here are a few most recent trends in lending apps for loans:

- AI & Machine Learning: They are used to evaluate credit scores, spot fraud, and to provide customised loans.

- Rapid Loan Approval. A lot of applications now provide instant approval by using electronic KYC along with credit assessment.

- Chatbots: Chatbots can help users find answers immediately, which improves customer service.

- Blockchain: Certain apps make use of blockchain to provide an encrypted and secure lending platform.

- The BNPL (Buy Today Pay Later): Apps are now providing this payment option that is aimed at younger users.

- The Voice Recognition Apps: These apps are now adding features that allow users to speak, for those who prefer speaking over typing.

- Mobile Wallet Integration: It allows users to get and pay back loans fast.

If you adhere to these guidelines, your app will look contemporary and user-friendly.

Which Loan Solution Is Right for a Lending Business?

Selecting the best loan solution will depend on your needs and the type of customers you want to serve. If you intend to offer services to people, a consumer-based loan app could be the most suitable. Small businesses should opt for a business-specific loan app. If your goal is to help those with lower incomes, microfinance apps are the best.

You must also think about whether you would prefer to handle all of the details yourself, as well as connect lenders with applicants through peer-to-peer applications. Some companies also opt for white-label services, which allow you to purchase ready-made applications and modify the apps to suit their needs.

Check that your application is secure, easy to use, and operates across the two platforms, Android as well as iOS. If you’re looking to allow your app to grow, consider cloud-based solutions. You can also hire hybrid app developers to create one app that can run across all platforms.

Consider your users’ requirements, competition in the market, and budget before deciding on the best solution.

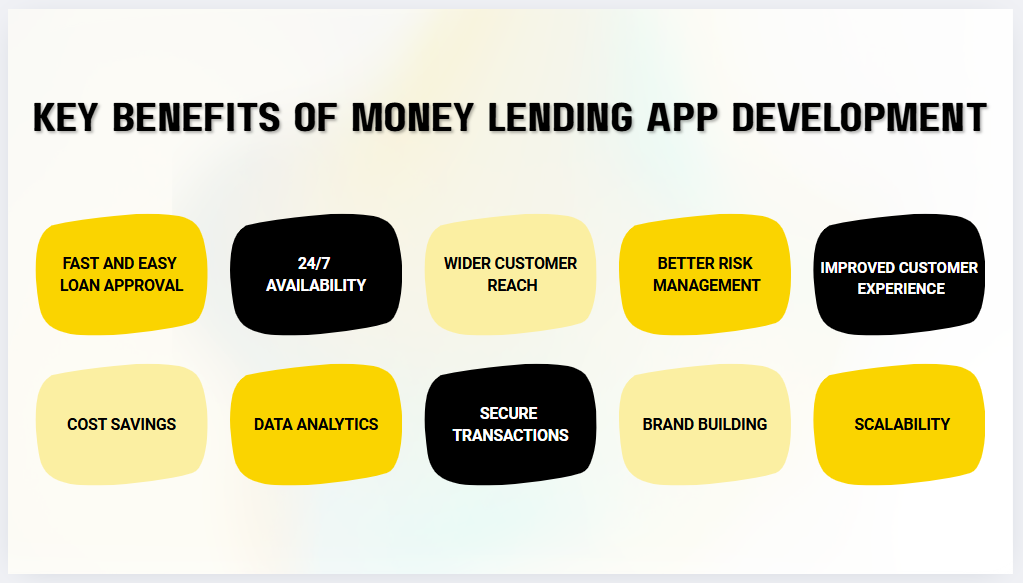

Key Benefits of Money Lending App Development

Developing a money lending application has many advantages for the business owner and the user. Let’s take a look:

1. Fast and Easy Loan Approval

Users do not have to go to banks or fill in lengthy forms. Everything is completed via the application, and the approval process is significantly faster.

2. 24/7 Availability

Customers can apply for loans at any time and even at midnight. This helps make the service more user-friendly and easily accessible.

3. Wider Customer Reach

Mobile apps enable users to connect with people in remote locations where banks might not be in existence.

4. Better Risk Management

With the help of built-in tools, you can assess the score of your credit and also track repayment patterns. AI systems aid in identifying fraud and risky customers.

5. Cost Savings

It saves cash on office rental as well as staff and paperwork. All of it is automated, which makes the company more profitable.

6. Improved Customer Experience

Real-time updates, real-time updates, and chat with support can make users feel more secure and educated.

7. Data Analytics

You have access to the user’s data that could assist in improving the quality of services. You will be able to understand the behaviour of users and make better plans.

8. Brand Building

An app that is well-designed helps to create a brand. You can advertise your service online and draw new customers quickly.

9. Secure Transactions

With the security of encryption along with secure payment processors, customers feel secure. This increases trust and builds loyalty.

10. Scalability

Your company can expand faster thanks to apps that allow the addition of additional features or scaling the operations with ease.

With the right plan and the right team, launching an app for money lending is an effective and profitable choice.

Requirements to Start a Money Lending App Business

Before you start your money lending app, here are the essential things you’ll need to know:

1. Business Plan

It is essential to have a clear picture of your objectives, who you want to attract and the way you plan to generate revenue. Determine the type of loans you’ll provide.

2. Legal Permission

You need to obtain a license and comply with local laws regarding lending. It is crucial to stay out of legal trouble later on.

3. Technology Team

You will require a team of experts to create and maintain your application. You could hire web developers or outsource the work to a seasoned App Development firm.

4. Secure System

Your app needs to protect user data and use the most secure practices, such as encryption and two-step verification.

5. Funding

It is necessary to raise funds to develop your app, advertise it, and provide loans. Find investors for your savings.

6. Marketing Plan

After your app is complete and you have a strategy to get your app noticed by users. Make use of SEO, social media, and ads on the internet.

Once these are in place, the business in the field of money lending will be getting off to a good start.

Build Your Own Loan Lending App Today

Create a seamless and secure digital lending experience for your customers with our step-by-step guide to developing a loan lending mobile app. From planning to launch, we’ve got you covered!

Steps to Create a Money Lending App

Here are the most important steps for building your loan application:

Step 1: Market Research

Learn about your competition and discover what the customers are looking for. Review reviews, ratings, and features.

Step 2: Choose App Type

Choose the kind of lending application you’d like to use: P2P Payday, consumer and so on.

Step 3: Hire the Right Team

Look for experienced developers. You might also consider hiring a skilled React development company to build your front end.

Step 4: Design the App

Create simple designs. Be sure that users are able to sign up, apply for and pay back loans quickly.

Step 5: Develop the Backend

Create a backend that manages information about users, including loan processing and repayments. Utilise secure and scalable technology.

Step 6: Integrate Payment Gateway

Users can send and receive funds through wallets or banks.

Step 7: Add Key Features

The most important features are:

- Registration and KYC

- Loan calculator

- Push notifications

- EMI schedule

- Chat with support

- Check your credit score

Step 8: Test the App

Make sure to fix all bugs and that it is working across all devices.

Step 9: Launch and Promote

Release the app on the Play Store and App Store. Advertise and promote the app through influencer marketing.

Step 10: Gather Feedback and Improve

Request feedback from users and keep the app updated.

API Used to Create Lending App

For creating a safe and reliable lending application, Plaid API is a good option. Plaid integrates the app with customers’ accounts at a safe distance which allows you to look up their income, bank amount, and history of spending. This assists lenders in determining whether someone is eligible to receive the loan. The API aids in identification checks and also keeps track of all repayments. With real-time information and solid protection, Plaid makes lending faster and more secure for everyone. It’s easy to incorporate into your application and is utilized by top fintech firms across the globe. If you’re creating an individual credit, loan and mortgage-related platform Plaid provides the resources to make smarter and faster decision-making in lending.

Ready to Launch Your Loan Lending App?

Challenges in Loan App Development and How to Overcome Them

- Regulatory Compliance: Apps for loans must adhere to strict regulations. Solution: Employ an expert in law to ensure that you are compliant.

- Data Security: Data of the user is sensitive. The solution is to use firewalls, encryption or secure APIs.

- Trust Issues: Some users may not be able to trust the latest applications. Solution: Show the licenses as well as transparency and offer good customer service.

- High Competition: There are a variety of loan apps. Solution: Provide distinct features and a better user experience.

- Technical Bugs: Applications may crash or contain bugs. Solution: Make sure you test thoroughly and regularly update.

- Scalability: As you expand and expand, you’ll need more resources. Solution: Utilise cloud servers that can scale easily.

- Delayed Payments: Certain users might not pay on time. Solution: Set reminders and provide plans that are flexible.

Take these challenges seriously to ensure that your app is running efficiently.

How Much Does It Cost to Build a Loan App?

The cost of the service is contingent on a variety of factors:

- Features and types of apps

- Developer location

- Platforms (iOS, Android, or both)

- UI/UX design

- Testing and security

A basic app could cost anywhere from $30,000 to $50,000. An app that is complex can cost over $70,000. Employing a local team will cost more than outsourcing. Also consider long-term costs like updates, hosting, and marketing.

The Role of Legal Compliance and Encryption

Loan apps handle the transfer of personal information as well as money therefore, legal and data security rules are crucial.

Legal Compliance

You have to adhere to the laws of your nation. This includes loan limitations, interest rates, and fair lending guidelines. The app must also permit users to understand the terms and sign a contract before taking out the loan.

Encryption

Information about the user, such as income, name, and bank account details, should be encrypted. This is the process of turning data into code that can deter hackers. Additionally, you should use passwords that are secure, such as OTP or passwords.

An app that is secure and legal increases trust among users and helps avoid large penalties.

Hire a Team of Fintech App Developers from Netleon IT Solutions

If you’re planning to develop an effective and reliable loan application, you need to partner with experts. Netleon IT Solutions offers skilled fintech developers who can design modern, user-friendly, secure, and safe applications.

They are experienced in the development of financial apps, including features such as KYC, EMI calculator, payment gateways and real-time alerts. The team they work with works from the beginning of planning until launching your application.

You can employ either part-time or full-time developers based on your requirements. No matter whether you’re looking for Android, iOS, or cross-platform applications, Netleon provides expert support. They are focused on performance, quality and security, which is perfect to be use by any Fintech start-up business.

Conclusion

Mobile apps for loan lending have revolutionised the way people can borrow money. They’re quick, easy and are able to reach a larger audience. If you’re thinking of starting a lending company, creating an app of your own is an excellent move.

This blog has provided you with an entire guide, from app types and trends to issues and development processes. With the proper approach and a strong team, your app will expand quickly and become a massive success. It is vital to abide by the law, secure the personal information of users and offer them the most enjoyable experience. In the event that you do not have an experienced technical team, joining an experienced App Development company can simplify your life.

FAQs

1. How long will it take to develop a loan app?

It can take between 3 and 6 months, based on the features and size of the team.

2. Does it make sense to provide loans via an application?

The answer is yes, however, you have to adhere to local lending laws and obtain permits.

3. Is it possible to build one application for both iOS as well as Android?

Sure, provided that you are using cross-platform technology. This is why a lot of people employ designers for hybrid apps.

4. What are the best characteristics of a loan application?

KYC, loan calculator, Payment system, push notification, and chat support.

5. Do I require a large team?

It’s not always. Web developers can be hired or outsource a portion parts.

Image by pch-vector on Freepik

More Blogs You May Like

- 9 Features for Best Mobile e-Commerce Apps

- Mobile Application Development for Businesses – A Complete Guide

- Why Ongoing Education is Critical in Full-Stack Development

- What’s the cost of developing Best eCommerce app similar to Noon?

- Develop A Video Streaming App like YouTube

- Maximise Efficiency with a Fleet Management App Like Samsara – Here’s How!

- Migrate From WordPress to Shopify in 2024

- The Dynamic Duo: Web Development and Android App Development

- Flutter vs. React Native in 2023: Which is Better?

- How To Integrate Third-Party Services Into Your WordPress Website?